If you partake in sports gambling, you can attest that it comes with a rollercoaster of emotions. When you win a wager, you feel like you are the smartest person in the room. The excitement of winning is met with regret for not placing a larger bet. On the other hand, when you lose, you question everything. Your bet size was not only too big; it was a bet you should have never made.

Investors battle similar emotions and biases as gamblers, even if they are less pronounced. One concept that is vital for both is the management of sizing your positions or wagers.

One topic that comes across my desk all the time is concentrated equity positions. Individuals have stocks that have grown to major portions of their portfolio. Common reasons for these large positions include accumulation of company stock from working careers, inheritance, apprehension to sell due to losses, and longtime outperformance compared to the rest of their portfolio. Below is my 4-step approach to addressing your concentrated position.

STEP 1-Identify Your Motivation

Your first step should be to identify your motivations for holding this concentrated equity position.

Emotionally Attached?

It is common that investors have an emotional attachment to large, concentrated positions. This could be due to generations of family ownership, or the fact you spent your entire career working for the organization. You need to acknowledge that you have this attachment, and that it is a personal stance that may defy traditional portfolio theory. If there is no need to sell the stock, then do not spend too much energy worrying about it. Close your screen and go outside for a walk.

Professionally Vested?

Another common motivation is vested professional interest. You work at the company, and you want to have a stake in the company. It is a sensible motivation because it adds alignment to the work you are putting in daily. Being in the organization may also give you a more informed opinion of the company. You may not be versed in capital markets, but you are in an advantageous position to judge people, culture, vision, and management.

Here motivation is like that of emotional attachment and boils down to a personal decision to buck traditional portfolio management. If that is your stance, take ownership and do not spend time obsessing.

STEP 2- Is My Concentrated Stock Position Too Big?

The reality is that most people have one foot in and out of the door. They are emotionally attached and/or professionally vested but did not stop reading in the last section and go out for a walk. They want to entertain traditional portfolio concepts.

Here is a simple 2-step check to see if your position is too big:

- If you are worried about not meeting your financial needs because of this position, you are too big. Whether that concern comes from lack of growth or excessive volatility, either is a red flag, and you should consider diversifying.

- Ask yourself how you would feel if the position lost 50% either over the next 2 months or 20 years. If that makes you sick to think about and is unacceptable, you are too big.

STEP 3- Lay Out Your Specific Situation

You need to see the full picture to make an informed decision on the next steps. Individuals all too often rely on mental accounting for their finances. Do not do that here. Instead, outline these details so you can more coherently assess your situation.

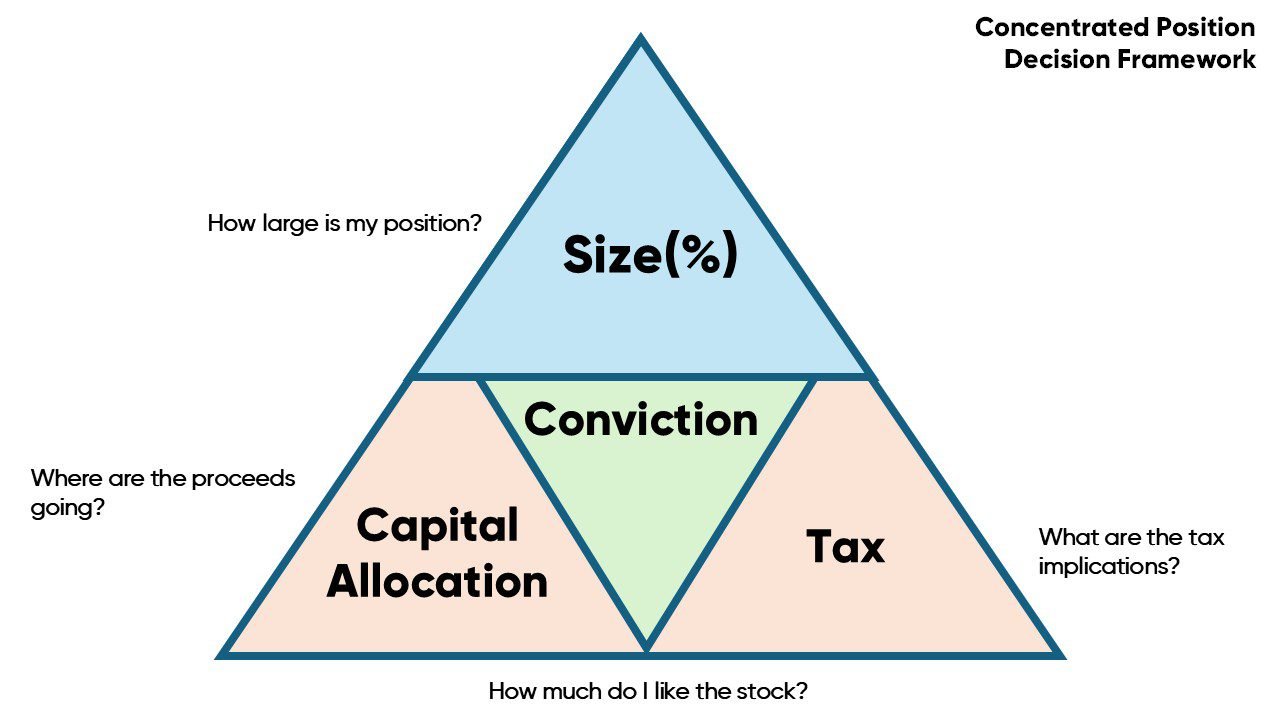

At the end of the day, you must assess: 1. The size of your position 2. Your conviction level 3. Capital allocation and tax implications of proceeds. Looking at any of those items in a vacuum does not do you justice.

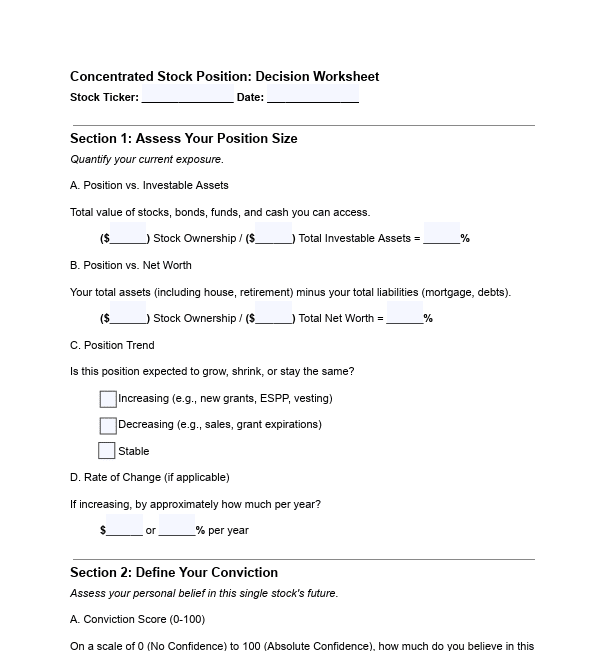

The above diagram lets you visualize the important components of this decision. To help you get a clear handle for your own position, below is a one-page, fillable worksheet. It walks you through quantifying your risk, defining your conviction, capital allocation implications, and action plan.

Here is a preview:

Download the full worksheet here: Concentrated Stock Position_ Decision Worksheet

STEP 4 – Act

The last step is to outline a game plan and keep yourself honest by sticking to that plan.

In the worksheet above, the last section is the trading and execution plan. Here you can document the action you are going to take. One terrific way to trim a concentrated position is to dollar cost average. You commonly hear about dollar cost averaging when putting money into the market, but the benefits of this strategy are just as powerful on the way out.

Lets we go back to our sports gambler in the introduction, they were a victim of the illusion of control cognitive bias, which is the tendency for people to overestimate their ability to influence events that are determined by chance. Just like there is uncertainty in the outcome of a sporting event, the trajectory of your concentrated stock position is unknown. Do not be naive in your ability to influence or predict the future; instead build a coherent action plan.

If you have questions about your concentrated stock position and would like to talk with us further, please call us at 513-271-6777. For more THOR reading, click here to go to the Blogs and Market Updates section on our website. Follow us on social media: