Benefits of Early Retirement Savings

Blog post

06/24/20When it comes to retirement savings, it is never too early to start. In the early stages of your career, retirement seems so remote that you might think you can delay saving for awhile. You may not earn a high salary, or you may have debt to pay off, but you have one factor on your side that your older colleagues do not. That factor is time. With time on your side, saving for retirement becomes more worthwhile.

There are a multitude of reasons why you should start you retirement savings early. This blog will focus on three key reasons: compound interest, opportunistic saving vehicles and time in the market.

Compound interest

Compound interest is when a sum of money grows exponentially due to interest building upon itself. It can be thought of as “interest on interest”. Compound interest is the result of reinvesting interest so that interest in the next period is earned on the principal and the previously accumulated interest. Over time, your money compounds upon itself.

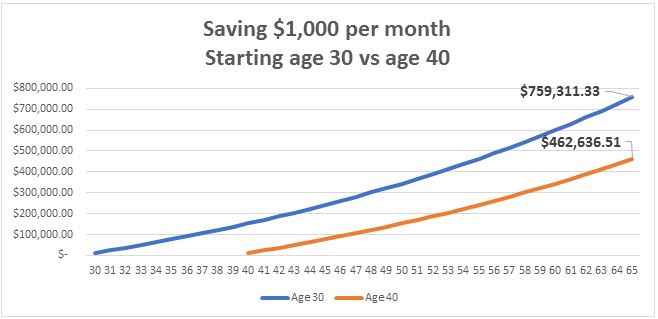

Let us look at an example of saving $1,000 a month with a 3% compound annual return, starting at age 30 compared to starting at age 40 and retiring at age 65.

If you save $1,000 per month with an annual 3% compound return, someone who starts at age 30 will have $760,000 of savings compared to $462,000 of someone who starts at age 40. The earlier you start saving, the more you benefit from compound interest.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” -Albert Einstein

Opportunistic Saving Vehicles

Early in your career, it is important to know which type of retirement saving vehicle is most beneficial for you. First and foremost, you should look to save in your employer-sponsored qualified retirement plan that offers an employer match. An employer match is “free money” and if you do not contribute to your employer-sponsored plan up to the match, you leave that free money on the table. Second, you should consider saving in a Roth IRA. In previous blogs, we have touted the benefits of Roth IRAs (Saving into a Roth IRA). There are limits to Roth IRA contributions based on one’s income. As a young investor you most likely have not reached the income limits and your income tax rate is most likely less than what it will be 20 years in the future, so it can be advantageous to start investing in a Roth IRA early in your career. If you do exceed the income limit, you can still contribute to a Roth 401(k), if your company offers the option to do so.

Time in the market

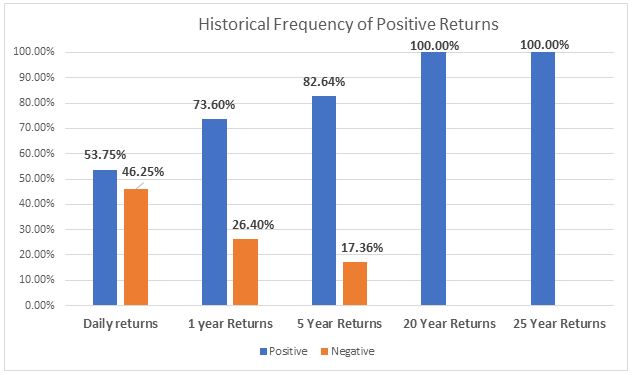

Another advantage of early retirement savings is the time in the market. The stock market provides a much better opportunity for long-term investors than short-term investors. Timing the market is not as important as time in the market. Historically, the longer you are invested in the stock market, the greater chance you have for positive returns. Shown in the graph below, since the start of the U.S. stock market, if you have invested on any given day, you have a 53% chance for a positive return. As you increase the time you are in the market, the greater the likelihood of positive returns. You can see, when you are invested in the stock market for 20 years, you have a 100% chance of positive returns. Granted, nothing is guaranteed when it comes to investing, but history shows the longer you have money in the market, the greater your chance for positive returns. Knowing you have a 100% chance of positive returns after 20 years in the market is a tremendous reason why young investors should start saving early in their careers.

To recap, the sooner you begin your retirement savings, the better. The longer your money is invested and reinvested, the more compound interest you earn – save early and save often! Take advantage of the retirement savings opportunities offered to you. Finally, view the stock market as a long-term commitment. Even if you do not have a lot to save, start today and get time on your side.