When it comes to Social Security, timing isn’t just everything; it’s money in your pocket. For many couples, especially those with a spouse who has earned significantly less over their career, spousal benefits can be a powerful tool to boost retirement income. However, claiming too early can shrink their benefits for life. Understanding why a lower-earning spouse might want to wait before filing can make the difference between a comfortable retirement and leaving thousands of dollars on the table.

Social Security Basics

Most working individuals pay a 6.2% social security tax on their income. The amount of earnings that can be taxed for Social Security is capped each year, which is $176,100 in 2025.

You earn social security credits each year, specifically one credit for every $1,810 in earned income in 2025, with a maximum of 4 credits available each year. To be eligible for social security benefits based on one’s own earnings record, one must earn 40 social security credits, or work for approximately 10 years.

The Social Security Administration then calculates your benefit using average indexed monthly earnings (AIME) to develop your Primary Insurance Amount (PIA). This is your social security benefit at full retirement age, which is 67 for most. Social Security benefits can be taken as early as age 62 and as late as age 70. Taking benefits before full retirement age will result in a reduced lifetime benefit, while waiting each year after full retirement age guarantees an 8% annual increase in benefits up to age 70.

How Spousal Benefits Work

Spousal benefits provide income to a married individual who has little to no work history. There are 0 work credits required to claim these benefits; they are based solely on the higher-earning spouse’s record. There are other eligibility requirements, however, that I have listed below.

- The higher-earning spouse must already be receiving benefits

- The lower-earning spouse applying for benefits must be 62 years or older

- The couple must be married for at least 1 year

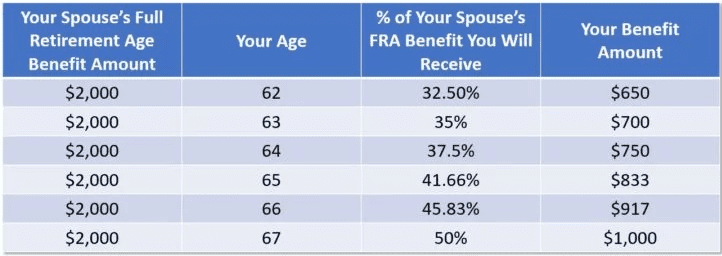

The maximum spousal benefit that can be received is 50% of the higher-earning spouse’s full retirement age (FRA) benefit amount. Claiming early permanently reduces benefits, as seen in the graphic below.

Source: Devin Carroll, https://www.socialsecurityintelligence.com/social-security-spousal-benefits/

Common Mistakes and Filing Strategies

Deemed Filing: If you file for one benefit, you are “deemed” to have filed for spousal benefits too, and vice versa. Prior to 2015, a lower-earning spouse could claim reduced spousal benefits at age 62 while letting their own benefits grow. This is no longer a filing strategy, and that individual would receive reduced spousal benefits for the remainder of their life.

Although there are no longer “strategies” that can be used to get a larger benefit, it is important to understand the consequences of claiming early and the advantages of delaying. Electing to take spousal benefits at age 62 will permanently decrease your benefit by 17.5%. Waiting until your full retirement age ensures you receive the maximum 50% of your spouse’s benefit, which can add up to thousands of dollars more over your lifetime.

This decision becomes even more impactful when you consider life expectancy, survivor benefits, and the possibility of outliving other income sources. Speaking with an advisor can help you create a financial plan that addresses these questions and guides you toward the best choice.

If you have questions and would like to talk with us further, please call us at 513-271-6777. For more THOR reading, click here to go to the Blogs and Market Updates section on our website. Follow us on social media: