Investing vs Gambling: What’s the Difference?

Blog post

02/16/23Gambling has never been so popular and accessible as it is today. Sports gambling is now legal in over half of the US. And if you live in one of the states, like Ohio, where it recently became legal, this is no news to you. Like gambling, investing has also grown in accessibility with the evolution of products and technology. This piece will outline what makes investing and gambling similar and shed light on their important differences.

Similarities In Investing & Gambling

Investing and gambling are similar in nature. One trait they share is that they both involve risk. You cannot get a return without taking on risk. Even investing in a treasury bill, which is termed a “risk-free” asset still carries the risk of the US government defaulting. Also taking on greater risk is associated with greater return in both gambling and investing. For example, you can invest in stocks instead of bonds, which will carry more risk, but gives you the opportunity for higher returns. Similarly placing a bet on a ten-leg parlay carries more risk than betting on a single game but the potential payoff will also be significantly higher.

Risk is a product of uncertainty. In investing and gambling the only thing that is certain is that nothing is certain. There are no guaranteed investments. Even if you get guaranteed payments in an annuity, you still have the risk that the insurance company will go out of business. Likewise, there are no “locks” when placing a bet of any kind.

Another common ground is the importance of information. While it may seem counterintuitive, there are professional gamblers. The reason they have an edge over your average joe is because of their information and sophistication. Much of the same can be said for the investing world. Without valuable information you are going to be at a disadvantage.

What Is The Difference Between Gambling and Investing?

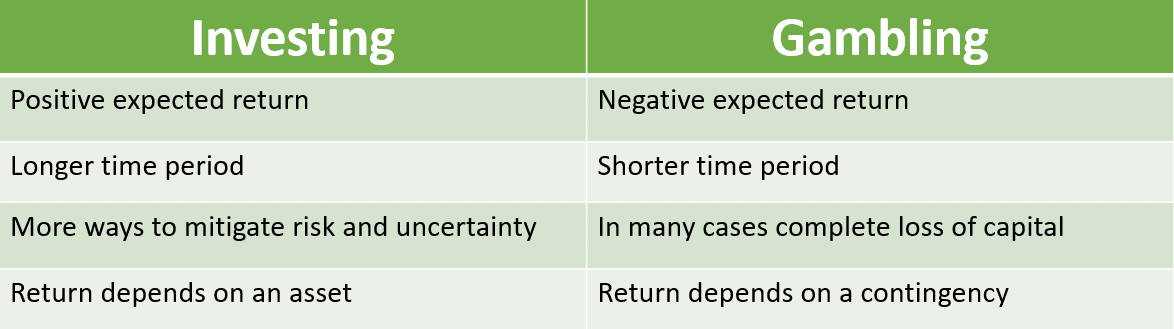

While the similarities are more apparent, the differences between gambling and investing are more subtle. They are also more important.

Gambling is usually based on a contingency or a future event happening, which means your return is based on that contingency. On the other hand, the return from an investment is derived from an asset. Yes, there are exotic investments like derivatives which are based on a contingency, but in many cases, they are less like investing and more like speculation, if not outright gambling.

Since gambling is usually based on a contingency, your downside is usually a complete loss of capital, and your time frame is short. If you put $100 on the Lakers to beat the SuperSonics by 5 points and you lose, your $100 is gone. In investing, your downside is usually selling your position at a loss. Defaults and bankruptcy do happen, which can cause complete loss of capital but are much less frequent and take time to play out.

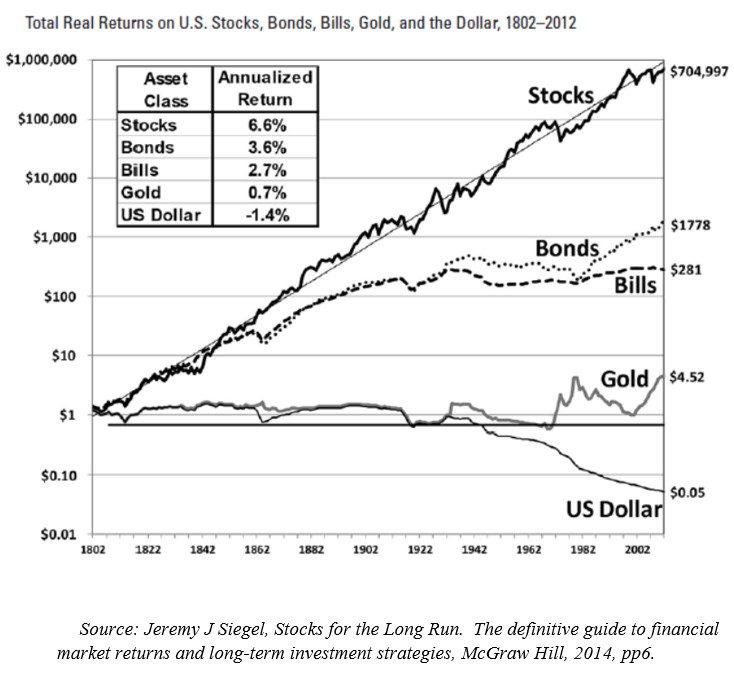

The most valuable difference and reason that gambling has a negative reputation is because of the difference in expected return. Investing has a long-term positive expected return. Attached below is a 200-year chart of stocks, bonds, and gold. This is a dramatic example of long term, but more a testament to the effect of compounding.

Gambling has a long-term negative expected return. This is the case because of the binary nature of a gamble. One side wins and the other side loses. And because of this the house will stack odds in their favor. For an event that has a 50% chance or (+100) odds of happening they will price that gamble at (-110) odds or 52.38% chance of that happening. So, you need to bet $55 to win $50. And if there is truly a 50/50 chance of that event happening, your expected return is -2.5% (((.5*$50)+(.5*-$55))/$50). The cost may be small on a single bet, but with the appropriate odds and volume, the house is on the side who reaps the effect of compounding. This is also why diversification is not as powerful in gambling. Bets are independent events that carry a negative expected return. Whereas, in investing, you can add asset classes that give a portfolio correlation benefit and reduce risk.

Conclusion

Hopefully understanding some of the differences in gambling and investing can help you make smarter decisions when participating. For example, always think about risk and uncertainty in relation to return in both investing and gambling. Use duration and compounding to your advantage in investing. And be cognizant of what the cost is for any bet you make.

If you have questions and would like to talk with us further, please call us at 513-271-6777. For more THOR reading, click here to go to the Blogs and Market Updates section on our website.

Follow us on social media: