Power of Long-Term Investing (Updated)

Market Updates

02/21/24The most important dynamic in investing is time. Time and the concept of compounding should be simple and practical but are often misunderstood and overlooked.

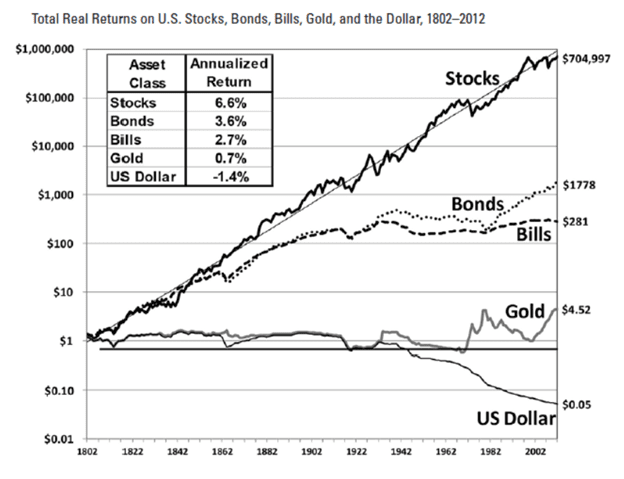

Source: Jeremy J Siegel, Stocks for the Long Run. The definitive guide to financial market returns and long-term investment strategies, McGraw Hill, 2014, pp6.

This chart is a great representation of long-term investing. Yes, it is an exaggerated timeline (none of us will get to watch our assets grow over 210 years); but the returns or effects of compounding are even more profound. It is hard to grasp the growth of a 704,997x return.

Here are 2 main takeaways from this chart:

1. Invest Your Cash

The most fundamental takeaway from this chart should be that you should invest your cash. The value of the US dollar has vastly devalued over time while every other asset class has compounded. Your $1 in cash has turned to a nickel, while even a balanced portfolio has compounded many times over.

2. Remain Invested

All asset classes/investments have volatility and periods when money is lost. While the line of stock returns may look like its straight up; it is not. There are periods of huge drawdowns. Likewise, in more conservative assets whether it be hard assets (gold/real estate) or lending (bonds/bills) there are also sustained periods of loss. What is important is that during these times investors do not liquidate but remain invested.

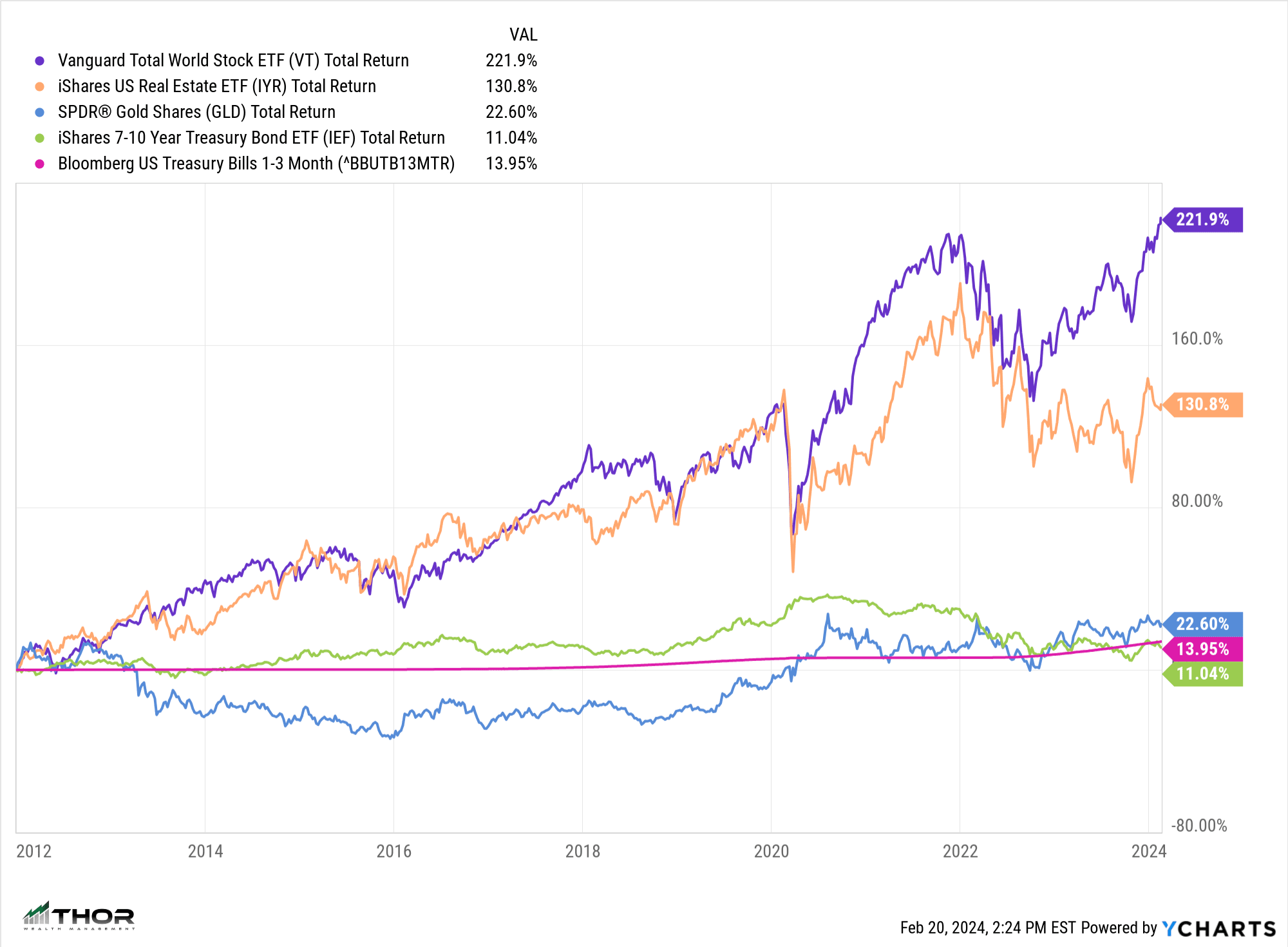

Shown below is an update to our long-term chart since 1/1/2012:

While it may be easy to say that 200+ years is unrealistic and today is different, what is interesting is that the past 12 years look eerily similar and epitomizes our previous lessons.

1. Invest Your Cash

Your $1 has turned into $.72 of earning power due to inflation over the past 12 years (not shown on the chart) and you would have been better off investing in any mix of those main asset classes.

2. Remain Invested

Over the past 12 years there have also been periods of volatility where it would have been easy to sell your equity or hard assets. This would have been the same classic mistake of not staying the course.

Conclusion

There are two things that you can do as an investor which will set you up for long term success. Invest your cash and remain invested. It sounds simple but it is not. It is difficult to save cash and scary to risk hard-earned money. You will inevitably run into periods where selling your investments seems like the smart thing to do for a multitude of reasons but will look dumb in hindsight.

At THOR we have a disciplined investment strategy that is designed to keep investors appropriately invested for the long term.

If you have questions and would like to talk with us further, please call us at 513-271-6777. For more THOR reading, click here to go to the Blogs and Market Updates section on our website. Follow us on social media: