Risk Tolerance vs Risk Capacity

Blog post

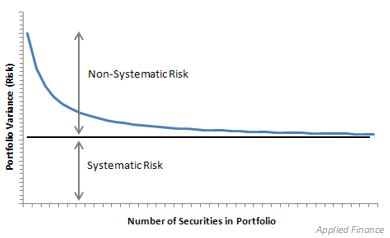

01/21/21The unpredictable year of 2020 reminded us of the fact that risk is inevitable in the market. The chart below shows what diversification can do to protect your portfolio – but it does not eliminate risk entirely. Regardless of how well you diversify your portfolio, there will always be systematic risk present.

When navigating risk for their clients, advisors monitor two important components: risk tolerance and risk capacity.

Risk tolerance

Risk tolerance is simply the amount of risk an investor is willing to accept.

A risk tolerant investor is comfortable allocating a larger percentage of their assets in riskier investments (usually stocks). Younger investors are typically more risk tolerant than older investors because they have an extended time to recover from a market downturn. A key point to remember about risk tolerance is it is a qualitative component; it is not something that can be measured. Although advisors can attempt to gauge a clients’ risk tolerance using a risk questionnaire, the final assessment produced by the questionnaire may not always accurately predict how the client will react during periods of market volatility.

Risk tolerance is also a variable that changes constantly – even in the short-term. Using 2020 as an example, your risk tolerance in January may have been very high (willing to accept risk). Yet, after the news of the coronavirus pandemic crippled the stock market in March, your level of risk tolerance may have come down some, hoping to never experience a similar kind of downturn.

Risk capacity

Risk capacity, on the other hand, is how much risk is necessary. It is the amount of risk one must accept to achieve their goals. Risk capacity is a quantitative component and can be measured.

The main takeaway when looking at your personal risk tolerance and risk capacity is understanding the spread between the two. Ideally, you want the risk that is necessary for you to take (your risk capacity) to be at or below the risk you are willing to accept (your risk tolerance). And because your risk tolerance is impossible to truly measure, finding your risk capacity becomes even more important.

Perhaps you are wondering why risk is ever necessary. In its simplest terms, it is necessary because of inflation. The cash sitting in your checking account or under the mattress will slowly begin to decrease in purchasing power over time due to inflation. Per YCharts, inflation has averaged a 3.22% annual growth rate since 1913, which means that $100 today can only buy $96.78 next year. So, if your money is parked in a checking account earning .5% annually, it is losing 2.72% annually to inflation. This is why taking on risk is necessary because it allows your money to sustain (and hopefully improve upon) it’s true value over time.

Where do you stand?

A holistic financial plan is the only true way to understand what your risk capacity is. A financial plan will assist you in determining if your current saving and spending practices will allow you to reach your long-term financial goals. A plan considers all the financial variables that may come into play as you strive to meet your goals over your remaining life. This will include, among other things, future income tax brackets, retirement income needs, income tax treatment of distributions and withdrawal rates. If the plan proves unsuccessful, it will outline steps to help get you on track. The results of a financial plan can get you on the right track earlier and/or improve your current situation. You may discover that you even have room to spare!

The fact is that without a financial plan it is impossible to know if you are maximizing what you want to accomplish with your wealth, now and in the future. A plan will allow you to spend with confidence knowing that you are on the right track. Without a financial plan, however, you will be only be guessing as to what your risk capacity truly is.

“If you don’t know where you are going, any road will take you there.” – Lewis Carroll