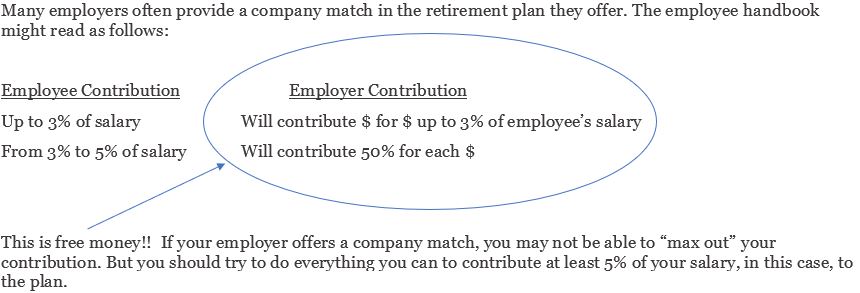

Often the mantra you hear when it comes to contributing to retirement plans such as 401(k) or 403(b) plans is to “max out your plan”. And, if you have the annual income necessary to meet these thresholds, you should absolutely take that approach. But there are many people who cannot “max out” their plan and piling all their annual savings into the company plan may not be in their best interests.

When you SHOULD contribute!

Safe Harbor Plans

Safe harbor plans can be slightly different from a traditional company match plan. For the business owner to avoid “nondiscrimination” testing of their company retirement plan, which relieves administrative burden and associated costs, an employer can offer what is known as a safe harbor match. Avoiding nondiscrimination testing might sound like a bad idea to the employees of the firm, but it really can be good for both employer and employee. Let’s take a look:

There are two options when it comes to safe harbor plans:

- Employer would contribute 3% of every employee’s salary (this is regardless of participation on the employee’s part).

- Employer can provide a 100% match on the first 3% of an employee’s contribution and 50% on the next 2% (employee must participate).

So, in Option #1, 3% of your salary is contributed toward your retirement balance regardless of whether you participate. Easy money – you don’t need to do anything.

In Option #2, you must participate but again, this is free money! Why wouldn’t you take advantage of this employer benefit?

When should you consider other alternatives?

The most obvious answer to this question is when your employer does not offer a company or safe harbor match. Then, depending on how much you plan to contribute and the quality of investments inside the retirement plan, a traditional or Roth IRA might be the best place for you to save your “retirement” funds.

Digging a little deeper on this option, if your total annual contributions to a retirement vehicle of some sort will be $6000 or less ($7000 or less if you are 50 or over) and your employer does not offer any match on your contributions, then the traditional or Roth IRA is a good option for you. You have more control of the assets and you have the universe of investments from which to choose to build your portfolio. You need to be disciplined with your contributions because you don’t have an employer automatically deducting your contribution from your paycheck every pay period. However, if you have the financial wherewithal to contribute $19,500 or $26,000, which are the annual maximum contributions to a retirement plan, depending on your age, then staying put in your company plan is the best place for you. As mentioned earlier, the maximum contribution to an IRA is well under these amounts so even though you are not receiving a match, saving often and early and to your maximum capability is to your advantage, as mentioned in our last blog.

The other less obvious answer to the question above is when an individual or a married couple can contribute to a combination of retirement plans and IRAs. There are several possibilities that fall in this category, but we will choose just one for illustration purposes. Let’s use a married couple in the following scenario:

- Both spouses work and are covered by an employer retirement plan.

- Both spouses make $100,000 per year

- Both spouses’ employers match their respective contribution $ for $ for the first 4% of their salary.

In this situation, both spouses should contribute 4% of their salary to their company’s retirement plan. Remember, that match is free money! Don’t leave that on the table! So, each spouse has contributed a total of $4000 to their plan and received another $4000 in employer contributions. But let’s also say that neither of the spouses are particularly happy with the investment selections in their retirement plan and each have another $4000 in discretionary income they would like to save. This is a great opportunity to open an IRA for each spouse and use that vehicle in which to deposit the additional savings.

There are several scenarios where a combination of a retirement plan and an IRA would be the best approach. Please check with your financial advisor or your accountant (or the web if you have neither) when it comes to the various income thresholds that govern IRA contributions as they can be quite confusing.