IRA Contributions

Blog post

04/02/24The 2023 tax season is almost complete – your tax return is due to be filed by Monday, April 15th unless you extend your return. But, if you have not yet filed your return, you still have a chance to have an impact on your taxes and/or your savings plan.

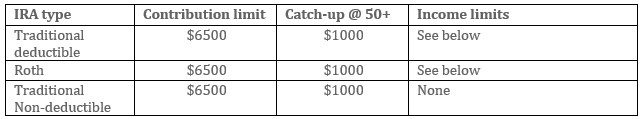

Let us go over some key facts first. The table below shows the limits for IRA contributions for the 2023 tax year:

Traditional Deductible IRA

By contributing to a deductible traditional IRA, you are reducing the tax you will owe for that calendar year. In most cases, how much you save depends on the tax bracket you are in. For example, if you are in the 22% tax bracket and make a $6500 IRA contribution, you will save $1430 ($6500 x .22) in taxes. Eligibility to contribute to a deductible IRA depends on whether you are covered by an employer retirement plan, your modified adjusted gross income, and your filing status. Here are some key points to use in determining whether you can deduct your traditional IRA contribution:

- Whether you are single or married & filing jointly, if neither you nor your spouse are covered by a retirement plan at work, your contribution to a traditional IRA is fully deductible.

- You are “covered” by an employer retirement plan if:

- Your employer has a defined contribution plan (401(K) plan, profit sharing plan, stock bonus plan) and any contributions or forfeitures were made to your account within the plan year

- Your employer has a defined benefit plan, and you are eligible to participate during the plan year.

- Note: Box 13 of the Form W-2 you receive from your employer should contain a check in the “Retirement plan” box if you are covered.

- If you are covered by an employer retirement plan and are under the following income limits for 2023, you can still deduct your traditional IRA contribution:

- Single – $73,000

- Married filing jointly – $116,000

- Married filing jointly & only one spouse is covered – $218,000

- Married filing separately – $10,000

Roth IRA

When you contribute to a Roth IRA, you do not receive a deduction on your tax return, but your contribution grows tax-free, and all qualified distributions come out tax-free. Essentially, you are betting that tax rates in the year of your contribution are lower than tax rates will be when you take a distribution. And between now and the end of 2025, when the Tax Cuts & Jobs Act (TCJA) sunsets, this is a surprisingly good bet. If you recall, most taxpayers received a tax cut when the TCJA was passed in 2017. If tax rates just go back to the levels experienced prior to the TCJA, most taxpayers will be paying more in taxes come 2026 so making a Roth IRA contribution for the next couple of years is not a bad idea. The other factor to keep in mind when deciding between a Roth or traditional IRA contribution is the amount of resources in your pre-tax and Roth buckets, a subject we have spoken about in a previous blog. If you are like most savers, most of your savings are in pre-tax vehicles such as traditional IRAs and 401(k)s. Adding to your Roth bucket can be a good idea just because of the imbalance in your current allocations. As far as income limits are concerned, here are the 2023 limits under which you can make a full contribution:

- Single – $138,000

- Married filing jointly – $218,000

- Married filing separately – $10,000

It is worth mentioning that for both traditional IRAs and Roth IRAs, if you file married filing separately, you are eliminating your ability to contribute to an IRA. This does not mean it’s not a good idea to choose that filing status, as the tax savings can be significant.

Traditional non-deductible

The traditional non-deductible IRA can be a suitable alternative if you cannot contribute to either of the two types of IRAs listed above. If your income does not permit you to make either a deductible or Roth IRA contribution, anyone can contribute to a non-deductible IRA and still take advantage of the tax-free growth of the IRA. Additionally, if you don’t have a deductible IRA in place, you likely can execute a backdoor Roth IRA by first contributing to a non-deductible IRA. If you need more details on this strategy, please give us a call and we can make sure you don’t do something that might draw the attention of the IRS.

One other note about a non-deductible IRA – you need to file a Form 8606 with your tax return for the year the contribution was made to alert the IRS that you have a basis in the IRA. This will avoid double taxation of the contribution when you go to withdraw funds in retirement.

Conclusion

There are multiple issues to think about when making an IRA contribution as I tried to demonstrate above so if you are ever in doubt about the appropriate strategy to implement, don’t hesitate to give us a call at 513-271-6777. For more THOR reading, click here to go to the Blogs and Market Updates section on our website. Follow us on social media: